«From the point of view of the science of Complex Systems, wealth distributions represent a unique example of a quantitative outcome of a collective behavior which can be directly compared with the predictions of theoretical models and numerical experiments.»

Anirban Chakrabortia,Loane Muni Tokeb, Marco Patriarca, Frédéric Abergel, Econophysics: Empirical facts and agent-based models, review paper submitted to Quantitative Finance, 22 juin 2010

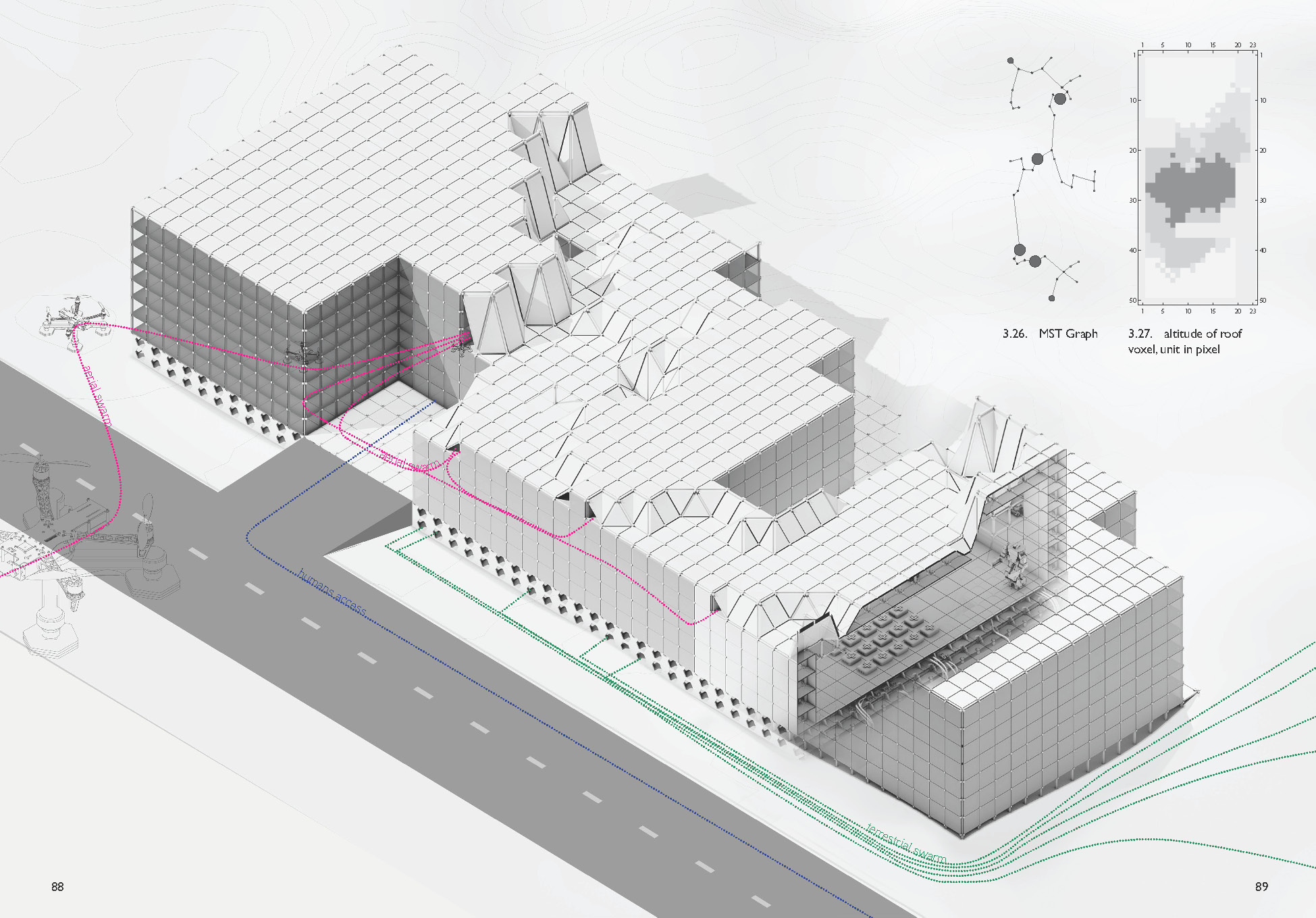

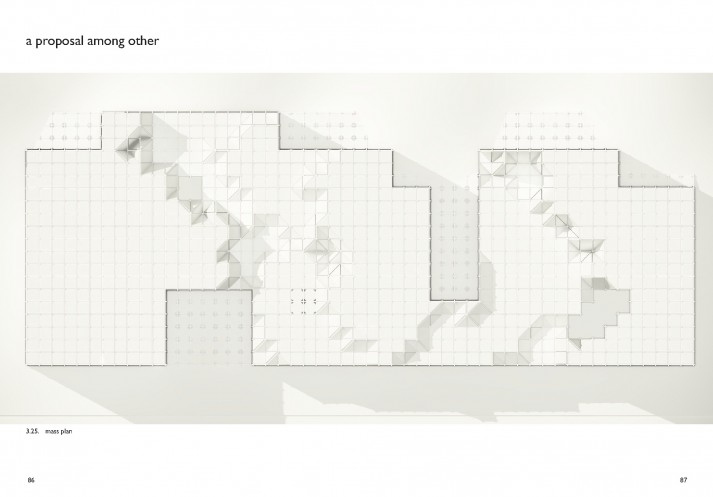

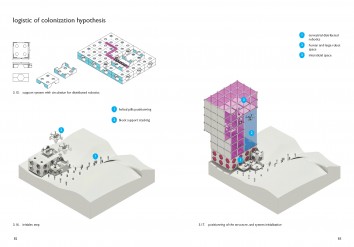

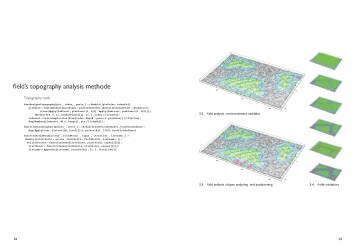

With the generalization of the computation at all levels, the time is near where all the elements constituting the process of creation and life of this architecture will be assembled and integrated on a global platform, in a large majority calculated and integrated into a logical whole nesting of functions at different scales.

In fact, when it comes to the architecture, it is obvious that we are left with extremely heterogeneous events that no single theory can not meet. However, with the widespread digitization of all processes related directly or indirectly to the architecture and which BIM is only a symptom already passed into law, we are left with a paradox which has to be solved as we are confronted to two problems, namely the heterogeneity of elements studied and the choice of a suitable formalism for these elements which we do not have an answer practical or theoretical, only possibilities and experiences in integrating more or less relevant.